While accounting for restaurants can be arduous, it doesn’t have to be a daily struggle if you choose the right approaches. Choosing accounting systems for restaurants can help you eliminate the difficulty with restaurant accounting and help you manage your food costs easily. These systems include financial software and point of sale (POS) systems to help you quickly organize inventory counts and execute transactions. It is a matter you cannot set aside when you put up a food truck business. Do not be lazy in keeping the record, and making the financial statements. The stereotype that accounting is hard will no longer be true for you.

- We have also provided you with online resources to assist in the tax process and financial decision-making.

- Food trucks often boast creative menus and innovative flavors, contributing to culinary diversity in urban areas.

- They also transmit orders to the kitchen, track inventory and monitor costs.

- The cloud-based software joins standard bookkeeping with ordering, invoicing, and staff scheduling.

How To Keep Accounting Records For Your Food Truck

Variable expenses change over time, which means they can be scaled back should you need to increase cash flow or face a sudden slump in orders. COGS are often a variable expense as you would need fewer ingredients for fewer orders. You want to maintain a positive cash flow, which means that your company’s liquid assets (cash, savings, investments) increase, and you have enough cash to cover your operations. Your cash flow may dip if you need to invest in a new set-up or pay for equipment upfront .

Real-time Inventory Data: The Stock Ticker

Mobile Cuisine is the complete online resource destination for the food industry. Our software helps in Booking and scheduling reservations, additionally sending automatic text messages to customers about their reservations. Our Automated kiosks https://www.bookstime.com/ cut down on the need for cashiers thus saving on employee payroll and taxes. E-Menu Guys offer the most advanced yet flexible POS system for restaurants in New York, New Jersey, California, and other major markets in the US & Canada.

Is a cloud-based accounting software the best option for my food truck business?

Creating a budget allows you to put money aside and save for a rainy day. That way, you’re never caught off guard by unexpected expenses, like repairs to your food truck or a sudden increase in orders. Operating expenses include all other costs for running your food business, for example, napkins, plates, marketing and advertising, equipment, etc.

- And of course, remember to get insurance and register your vehicle with the local regulations.

- Understanding your cost-to-sale ratio also helps you know how you stack up to other food businesses and get a clear picture of your finances.

- Find out how much revenue you make each day and ideally break them further into food and beverage categories.

- A food truck is a mobile restaurant, often selling food at designated areas, street corners, or festivals and special events.

- Outgoing expenses should be recorded with the help of receipts and invoices.

- The main difference between an income statement and cash flow is that the cash flow report tracks the flow of cash you have on hand (or in your bank) or your solvency.

Clover Pricing

How to run a successful food truck often comes down to your profit margin. Your food truck’s profit margin measures the percentage of revenue you keep after covering outgoing expenses. In other words, profit margin lets you know your profit for each dollar of sale.

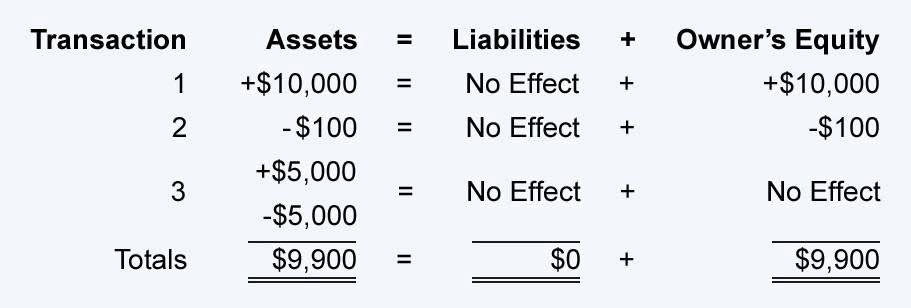

As a food truck owner, you must also pay federal income tax annually based on your food truck’s net profit. When considering a POS system for your food truck, there are many features to consider. These include the ability to accept offline payments, menu optimization, customer-facing display options and quick register buttons. food truck accounting Using specialized software like ZarMoney helps streamline your operations, makes accounting easier, and provides specific features that cater to your food truck business needs. More than a trendy name and landing page, your accounting service needs a reliable general ledger to track transactions, assets, and liabilities.

TouchBistro Food Truck POS Features

Moreover, by having access to useful information, you will be able to make wise business decisions and be resistant to changes in a speedy manner. ” there are a few important things you’ll have to check off your list. Our software enables restaurants to create custom membership programs, coupons and discounts, gift cards ensuring loyal customers for your Restaurant. E-Menu Guys, a leading New York Tech Company, is here to service your restaurant or any food ordering business with the latest Tablet E-Menu, Self Ordering Kiosks, and the latest POS system out there. We provide the hardware, software, training, and technical support that your business requires to be competitive and cost effective.

If your restaurant has more than $1 million in revenue, switching to accrual is best. Accrual accounting records financial transactions as they happen, whether you have received payment or not. Despite its name and low cost, ZipBooks shouldn’t be mistaken for a store-brand Quickbooks. The comprehensive service offers billing, financial reports, customer communication, expense tracking, document security, vendor management, and organizational tagging for your accounting books. Its price packaging has three tiers — free, $15 per month, and $35 per month, notwithstanding free trials and adjusted prices per employee.

- Integrated payment options allow customers to conveniently settle their bills, ensuring prompt and accurate revenue recognition.

- Occupancy expenses may also include any utilities or insurance, like van insurance, that you have to pay.

- You also have the choice to integrate your POS with third-party payment processors, such as Adyen or FreedomPay.

- To evaluate the costs, divide the staff into groups of kitchen staff or managers to see which group is costing you more.

- Maybe you’ll level up and start offering takeout or taking reservations.

Find the Right Software

If you’re looking for a lean, cheap service to measure payables and receivables, complete payroll, and pay bills, Quickbooks is probably all you need to spend money on. Once you have your net income, it’s easy to find your net profit margin. To calculate your food truck’s net profit margin, divide your net income by your revenue and multiply by 100.

Los comentarios están cerrados.