During these conferences, we hand over change initiatives as and when they are started or accomplished, and convey all stakeholders collectively to supervise the transformation. First, we combine finance strategy and enterprise structure with our distinctive CFO Labs service to strategise the futureproofing of your small business. This underscores the worth opportunity whereas also addressing a common misconception among companies hesitant to begin out their AI journey. According to the 2023 PwC Global Advisory Survey, the highest 20% of companies capture greater than thirteen instances the performance premium of their industry peers. These top performers make extra frequent and significant capital reallocations, extra rapidly establish digital finance transformation and act on dangers and opportunities, and drive mutually reinforcing investments.

Benefits Of Digital Transformation In The Finance Sector

Therefore, continuous learning and innovation are the one options available for businesses to thrive in 2024. Indeed, cloud offers are flexible, making it straightforward to increase or reduce allotted sources according to enterprise wants. Many use circumstances are nonetheless on the experimental stage, but some applications are already having a decisive impression on the monetary processes of firms.

Driving Efficient Change Management In Digital Finance Transformation

As you implement the roadmap, monitor progress and measure success against the aims and expected outcomes. Identify any areas that want improvement or changes to ensure maximum profit from the changes. Continue communicating with key stakeholders to make sure they are up to date with progress and on board with any modifications. Once your assessment is full, develop an action plan and timeline outlining what needs to be done, who needs to do it, and when it needs to be accomplished. As part of the planning course of, contemplate potential risks and implement appropriate threat administration measures. Digital transformation in the finance sector is not a expertise upgrade, but a core business strategy.

Digital Banking Transformation: Accelerating Into 2024

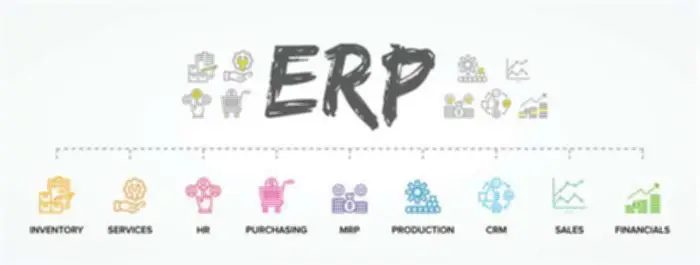

At one multinational company, utilizing EPM to redefine its enterprise knowledge mannequin formed the premise for a new chart of accounts design, as well as enabled it to reap the benefits of enhanced reporting capabilities earlier. The firm was able to check key systems with minimal risk or value of failure, supporting a smoother transition when the longer term ERP came online. This requires a reimagined knowledge and reporting strategy, with cross-functional groups tying together the two main reporting streams — financial and non-financial — which are essential to generate actionable insights. Instead of working in silos, financial methods ought to be intently built-in with operational data sources to eliminate gaps, confusion and bottlenecks that may delay the transmission of significant insights.

Finance transformation is important for organizations to remain aggressive and successful. It helps them enhance efficiency, cut back costs, and increase transparency in processes and decision-making. Furthermore, it could help enhance worker morale by permitting them to concentrate on extra strategic duties instead of wasting time on mundane tasks and inefficient processes. Drawing from years of main business-driven and tech-enabled transformation at scale.

However, your job is to know that your group members may be resisting new technologies and processes due to worry of job displacement or unfamiliarity. Not only does it permit refinement earlier than it’s rolled out, this is also a greatest follow by method of change administration. Iif a PoC works in a certain business unit (BU), implementing it in another turns into easier, as those which are confused can talk to members of the primary one to get direction and listen to the constructive associations.

A examine performed by KPMG in 2023, for instance, confirmed that 59% of finance managers at corporations with gross sales of over $1 billion were already using AI instruments in their tax or monetary processes. Our greater than 742,000 folks in more than one hundred twenty countries, mix unmatched expertise and specialised expertise across greater than forty industries. We embrace the facility of change to create worth and shared success for our purchasers, folks, shareholders, companions and communities. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee («DTTL»), its network of member companies, and their associated entities.

CFOs are starting to understand that digital transformation cannot be a bandwagon impact; it’s a singular want for each enterprise. Besides business trends, prospects expect one of the best in phrases of simplicity, alternative, and 24 x 7 immediate service. About 22% of shoppers favor and frequently use net banking and cell apps — 10+ occasions in a month — for all their banking wants. Generative AI has the potential to impact the economic case for legacy migration. I think 2024 might be the year that open banking turns into a mainstay within the world financial panorama.

- Need assist growing a digital finance technique and taking the following step in your journey towards a better, faster, and cheaper finance organization?

- While a shared companies strategy has turn out to be well-liked for centralizing processes and information, centralizing features can’t get rid of the difficulties of capturing macro views of the entire enterprise.

- The altering market and push towards new know-how make it crucial to evolve.

For a enterprise operating in multiple industries, this was no small feat, and it made possible a worldwide shared companies mannequin and streamlined intercompany processes. We labored with the client to develop a goal world operating mannequin to establish which processes would be retained in the business units and which would be phased into the shared services facilities. Auditoria is a comprehensive answer designed to improve the finance workplace operations of recent businesses. With clever apps that automate with AI and machine studying know-how, Auditoria works to help finance teams by streamlining financial duties, enhancing collaboration, and making your knowledge extra highly effective with automated analytics. Powerful advancements in know-how and automation are the catalysts of this transformation, enabling finance groups to give attention to creating value and driving revenue.

That’s why it is up to CFOs and different leaders to find a system that prioritizes information safety. Within a digitalized system, sensitive data could possibly be saved within a secure cloud-based system. SaaS options which may be designed for finance teams typically supply superior security to guard sensitive data and limit those that entry it, even inside a group.

Effective change management engages employees in any respect ranges of the organization, from finance executives to frontline staff. By involving staff within the change process, organizations can foster a culture of ownership, empowerment, and innovation, resulting in higher ranges of adoption and success. Instead of ready 18 months or longer for an ERP implementation, corporations can begin to capture worth from EPM in as little as three months. It can also determine roadblocks such as weak data streams, convoluted processes and workforce gaps, which can must be addressed earlier than or throughout an ERP implementation.

Digital finance is the time period used to describe the influence of latest technologies on the monetary companies industry. It contains a variety of products, applications, processes and enterprise fashions that have transformed the standard means of offering banking and monetary companies. The monetary and banking sector has undergone a major digital transformation in 2023, pushed by a focus on ESG commitments, macroeconomic uncertainty, a renewed give attention to risk management and the rapid unfold of automation. This transformation is anticipated to continue in 2024, with technology playing a leading position. One of essentially the most obvious advantages of digital finance transformation is the significant improvement in buyer expertise transformation. This, coupled with advances in knowledge analytics, cloud computing, synthetic intelligence, and blockchain technology, has supplied leaders in finance with tools to revolutionize their companies.

While digital finance transformation guarantees to revolutionize the monetary industry, it also presents its fair share of challenges and potential obstacles. Digital finance transformation empowers you with data-driven insights essential for efficient financial administration and decision-making. The foundation of digital finance transformation lies in digitizing operations and processes. By replacing guide processes with an automated, related setting, your entire business can profit from lowered costs, improved reporting, scalable techniques and a extra productive, motivated finance function.

Digital transformation in finance, pushed by technologies like Python, R, Tableau, Power BI, and Microsoft Azure, boosts efficiency, minimizes guide work, and provides insightful analytics for strategic decision-making. Finally, fashionable digital tools enable invoices to be systematically reconciled in an error-free manner with their corresponding financial institution transactions. This makes the company’s accounts a lot easier to manage whereas enhancing accuracy for finance teams. As regulatory frameworks evolve to accommodate this burgeoning sector, DeFi has the potential to democratize entry to financial services on a worldwide scale. In 2024, will in all probability be a matter of deploying AI with practical use instances for businesses and never just for the pattern.

Transform Your Business With AI Software Development Solutions https://www.globalcloudteam.com/

Los comentarios están cerrados.